As we enter tax season, you might be wondering how to access your 1098 and 1099-INT form with us. These tax forms will be located on the last page of your December 2024 statement.

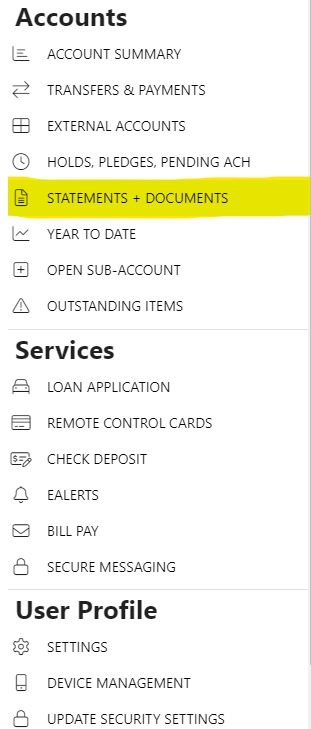

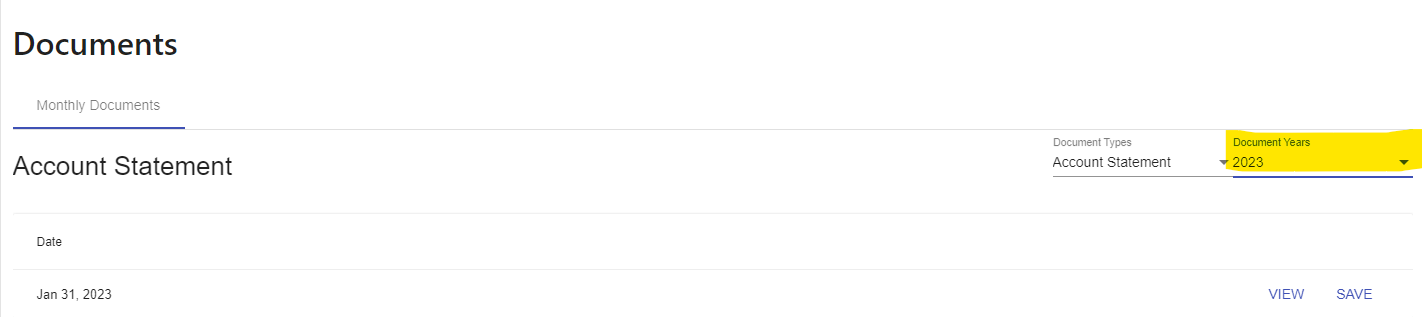

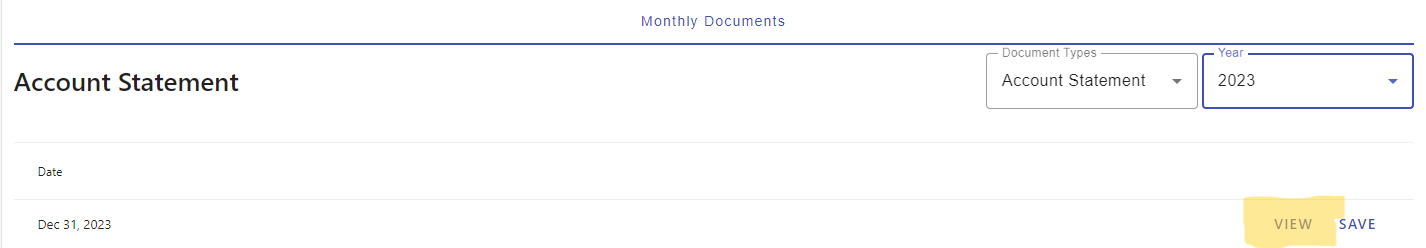

If you are signed up for e-statements, you can access your December 2024 statement via online banking using the instructions provided below.

If you are signed up for paper statements, you would have received your 1098 and 1099-INT in the mail with your December 2024 statement. If you no longer have that paper statement, visit your local branch to receive a copy of your statement.

If you have an IRA with us you will receive your 1099-R in the mail.

Please note

You will only receive a 1098 if you meet this minimum:

- Loan Interest - Over $600 Paid

You will only have a 1099-INT if you meet this minimum:

- Dividend Interest - Over $10 Received